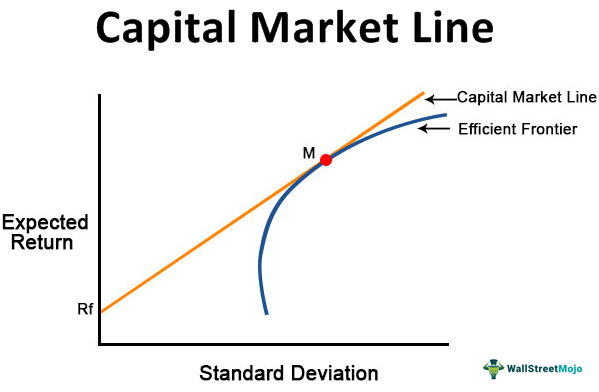

How can the Capital Market Line (CML) extend above the efficient frontier on either side of the tangency point where it touches the frontier? If the frontier encompasses all the most efficient allocations, how can there be something above this?

Is it because the efficient frontier doesn’t include the risk-free-rate, while the CML does, allowing for a superior risk-adjusted allocation? Or is there more to this that I’m not understanding.