Maybe I’m a giant nerd, but I find these target date retirement funds from BlackRock, Vanguard, etc really appealing…

http://www.oregon.gov/PERS/OSGP/docs/LifePathFS.pdf

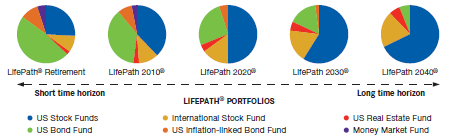

The investor simply figures out the year that they want to retire (say, 2045), and then invests in the portfolio that corresponds to that year.

You get an asset allocation (to bonds, inflation-protected bonds, domestic stocks, foreign stocks, commodities, real estate, etc) that is appropriate to your age. And the fund changes allocation every year to reflect your shortening horizon.

All for a tiny fee of 0.2% or so.

It’s really kinda genius.